Take Action

If Not Now, When?

While you read this on Monday, September 19, Hurricane Fiona is threatening the east coast of the US after ravaging Puerto Rico, tornado warnings have been declared in the middle of the country, and communities along the western coast of Alaska are struggling to recover from Typhoon Merbok, the worst storm to hit the state in 50 years. These events come after a summer of wildfires, floods, landslides, droughts, and other kinds of natural disasters affecting virtually all U.S. communities. The only constant is that charitable nonprofits have stepped in to provide relief, recovery, and support, all while also suffering their own losses.

Nonprofits need resources to keep these efforts going, and they need them now! A coalition of national nonprofits sent an updated letter to the President and congressional leaders stressing the need for restoring expired charitable giving incentives and the Employee Retention Tax Credit so nonprofits have much-needed resources to support relief and recovery efforts in their communities.

Take Action: Tell your Senators and Representatives they must enact disaster relief legislation that restores and expands expired charitable giving and employment tax incentives before the next natural disaster hits. Not at the end of the year, but right now!

- Email (Representatives, Senators) and tweet to your Representative and Senators the new nonprofit disaster-relief letter. https://bit.ly/3TD9l0G

- Retweet messages from @NatlCouncilNPs and #Relief4Charities to your Representative and Senators.

Congressional Job One: Keeping the Federal Government Open

The highest priority for Congress in the coming weeks is to avert a government shutdown after September 30, the end of the federal fiscal year, by passing a short-term funding measure. Although no one is threatening to block a stop-gap bill, called a Continuing Resolution or “CR,” congressional leaders and the Administration are still working through various provisions that may or may not be included in the legislation. The White House has requested $47 billion in additional spending for Ukraine support and relief, COVID-19 and monkeypox vaccines, and relief from natural disasters. In making the case for $6.5 billion to respond to natural disasters, the Administration stated, “We need additional funding that supports the people of Kentucky as they recover and rebuild from recent flooding, as well as communities that have remaining unmet recovery needs as they rebuild from major disasters, including those in California, Louisiana, and Texas.” (Emphasis added.) This focus on natural disasters parallels the calls on the Administration and Congress by the charitable nonprofit community to provide relief from disasters by restoring expired tax provisions – charitable giving incentives and the Employee Retention Tax Credit – all of which are regularly enacted in response to natural disasters. See Action Alert, above, and take action today!

Worth Quoting

- “Doing nothing is the default so close to the election, sadly. Many are working to generate the groundswell of support for restoring the expired natural disaster tax relief provisions."

— David L. Thompson of the National Council of Nonprofits, quoted in The charitable point-of-view, Bernie Becker, Politico Weekly Tax, Sept. 19, 2022, calling on all nonprofits to create that groundswell by engaging with their Senators and Representatives.

Worth Reading

- Nonprofits and Foundations Rush to Bring Drinking Water to Jackson, Miss., but Cash Donations Are Slow, Kay Dervishi and Eden Stiffman, The Chronicle of Philanthropy, Sept. 9, 2022, on the grassroots coalitions that are working to distribute supplies to Mississippi residents recovering from the damages from recent flooding to Jackson’s main water-treatment facility.

- Nonprofits beg for Congress’ help with staffing shortages, Eleanor Mueller, Politico, Sep. 12, 2022, on bipartisan solutions, such as the Employee Retention Tax Credit, that can address nonprofit vacancies, as well as challenges due to the government’s failure to regularly update data on the nonprofit workforce.

Nonprofit Employees and Employers:

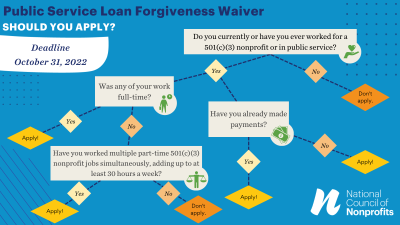

Take Advantage of Temporary Relief Under the Public Service Loan Forgiveness Program

This limited waiver expires on October 31. Check your eligibility today!

Whether you are an employee or employer, we urge you to take these simple yet important actions today:

Employees with federal student loan debt:

- Check your eligibility for the limited-time PSLF waiver

- Tell as many other nonprofit workers as you can!

Nonprofit employers:

- Tell your employees - today - to check their eligibility for the limited-time PSLF waiver. We've created a sample email you can use to inform your employees.

- Be prepared to certify your employees' certification forms and have your organization's EIN handy.

- Spread the word to other nonprofit employers to tell their employees, too.

Retweet the image above, with links in the tweet nonprofit employees and employers can use.

Federal FastView

- Community Data Partnerships: As part of an effort to advance equity for underserved communities, the White House recently released a request for information seeking input on how the federal government can encourage equitable data collaboration between different levels of government, grassroots organizations, and local communities. Specifically, the government asks seven questions seeking "information on how Federal agencies can better support collaboration with other levels of government, civil society, and the research community around the production and use of equitable data.” The term “equitable data” is defined as “data that can indicate how well government programs and policies serve different populations.” The public is invited to submit comments by October 3. See White House announcement.

- Public Charge Rule Revised: This month, the U.S. Department of Homeland Security (DHS) published a final rule restoring immigration policy to pre-2019 criteria. Historically, noncitizens could be denied admission to the U.S. or lawful permanent residence status if they were deemed likely to become a “public charge,” meaning that they would likely become dependent on the government for subsistence. Prior to 2019, almost all non-cash government benefits such as Medicaid or nutrition assistance were excluded from consideration. The Trump Administration changed the “public charge rule,” but a federal court ultimately blocked the revisions. This month DHS restored the historical understanding of the rule so immigration officials will not consider noncash assistance like the Supplemental Nutrition Assistance Program (SNAP) or Medicaid in applying the rule. Many nonprofits had expressed concerns that the Trump-era public charge rule would have caused disparate treatment of immigrant families who are at or near the federal poverty level.

- Senate Retirement Security Bill: Last week, the Senate Finance Committee released the text of the bipartisan measure that includes some charitable giving incentive provisions from the Legacy IRA Act (S.243) that would allow seniors to make a one-time $50,000 donation to a qualified charitable organization through a split-interest trust. The provisions in the new bill, the Enhancing American Retirement Now (EARN) Act (S.4808), are very similar to those in the retirement security legislation that the House passed this summer.

- Defending Form (1023-EZ) over Substance: The outgoing head of an IRS section is defending the IRS Form 1023-EZ application for tax-exempt status in response to continuing criticism from the IRS Taxpayer Advocate, the National Council of Nonprofits, state charities officers, and a New York Times investigation. The IRS adopted the form in 2014 in response to a perceived political scandal and growing backlog. The three-page form allows an applicant seeking tax-exempt status to claim to satisfy essential nonprofit qualifications, rather than actually proving they are in fact eligible and understand what the status requires. In a recent post, Streamlining the 1023 – A Success Story, Sunita Lough, Commissioner of the Tax Exempt and Governmental Entities division, argued that the Form 1023-EZ is simpler and reduces burdens on taxpayers, while asserting that the IRS is doing a fine job identifying which organizations are and are not eligible. Most commentors reject the rosy assessment of the form’s administration and call for reform to protect the public from bad actors exploiting the known loopholes and weaknesses in the system.

Worth Studying

The U.S. Census Bureau has published a series of reports.

- Income in the United States: 2021

- Poverty in the United States: 2021

- Health Insurance Coverage in the United States: 2021

In Pandemic’s Second Year, Government Policies Helped Drive Child Poverty Rate to a Record Low, Cut Uninsured Rate, New Census Data Show, Center for Budget and Policy Priorities statement, Sept. 13, 2022

Clarifying the News

Billionaires Giving to “Political Nonprofits"

Recent news reports of donations to “nonprofits” by conservative and progressive billionaires to advance their personal political and policy goals raise questions in the minds of many about the nonpartisanship of the charitable nonprofit sector. Those reports, however, usually left out that the billionaires gave to noncharitable entities organized as 501(c)(4) social welfare nonprofits. Such gifts do not generate charitable deductions, but the donors are able to avoid estate and most gift taxes, according to this New York Times analysis. Had the donations been made to a Section 527 political organization, they would have been subject to the capital gains tax on appreciation of the value of the assets. Charitable nonprofits can rest assured that the longstanding Johnson Amendment to federal tax law remains the law of the land, protecting charitable organizations from engaging in partisan, election-related activities.

Promoting Democracy

Agreeing to be Agreeable

Virtually everyone in the United States considers democracy to be the best form of government. Of late, however, it seems that partisans operate under their own notions of what democracy means and accuse “the other side” of breaching norms, engaging in undemocratic tactics, and justifying expediency for accomplishing goals. As charitable nonprofits dedicated to nonpartisan promotion of democracy, we’re here to say the ends do not justify the means and that self-evident truths are not malleable for the moment. In this spirit of unity, we offer the following efforts of transcending partisan views for the sake of the democracy:

- Two Judges: Two federal circuit court judges - one an African American female Obama appointee, the other a White male Trump appointee – penned an opinion essay in The Washington Post aimed at ending the current “era of poisonous tribalism.” They offer five suggestions to help form a “more perfect union.” First, they recommend logging off from “online incivility” that “seems to fuel real-life boorishness.” They also urge citizens to learn up on civics, particularly about the true workings of the judiciary. Additional ideas include reaching out to talk, civilly, with people who see the world differently, pulling back from politics (“There is more to life than politics”), and plugging in, as in being “engaged citizens, not enfeebled (or enraged) bystanders.” How to counter today’s tribalism and build ‘a more perfect union’, Bernice B. Donald and Don R. Willett, The Washington Post, Sept. 16, 2022.

- Two Governors: Former Governors of Tennessee – Republican Bill Haslam and Democrat Phil Bredesen – have teamed up to offer debate without discord about some of the serious issues of the day. Each episode of their new podcast, You Might Be Right, tackles a tough topic like gun violence, climate change, and the national debt, and features conversations between Governors Bredesen and Haslam and guests with differing viewpoints. Ultimately, the goal is for listeners to hear a point or perspective different from their own and think, at least once, “you might be right.” Tenn. Republican and Democrat try to find common ground in new podcast, Dan Balz, The Washington Post, Sept. 17, 2022.

Tracking ARPA Fund Investments

State and local governments continue to dedicate portions of their American Rescue Plan Act allocations on the work and needs of residents and charitable organizations in their communities:

Food Security: In Colorado, a county board of commissioners approved $1.7 million for the Jefferson County Food System Grant. $100,000 will be administered as technical assistance contracts to help grantees. The goal of the grant is to “foster a local food system that ensures equitable access to nutritious, locally produced food.” Earlier in September, Franklin County, Ohio, provided the Mid-Ohio Food Collective an additional $2.5 million in ARPA funds through a unanimous resolution in response to the increase in visits to food pantries in the County. The nonprofit’s CEO estimates that Franklin County has seen a 40 percent increase in visits compared to 2020, and the increased resources will help the organization work under the pressures of inflation and supply chain issues.

Homelessness & Housing: In Texas, Austin’s Homeless Strategy Division and Innovation Office announced the 21 nonprofit recipients of the city’s Organizational Capacity Building Initiative. The designated entities will receive technical assistance and grants of up to $45,000 to “support and increase the capacity of service provers in Austin’s Homelessness Response System.” Grantees were selected based on an evaluation that included a panel of community advocates and people with lived experience of homelessness as part of the Initiative’s community-informed approach. The initiative aims to build pathways for organizations to access government funding, expand services, improve equity, and integrate previously excluded organizations into the system.

Tracking ARPA Spending

Nationwide: ARPA Spending, National Council of Nonprofits, updated regularly.

State & Local: State and Local Fiscal Recovery Fund interactive dashboard, Pandemic Response Accountability Committee, updated regularly.

State: ARPA State Fiscal Recovery Fund Allocations, National Conference of State Legislatures, updated regularly.

Local: Local Government ARPA Investment Tracker, Brookings Institute, updated regularly.

Worth Reading

- States Divvy Up Federal Covid Billions With More Equity In Mind, Donna Borak, Bloomberg Tax, Sept. 14, 2022.

- How Localities in One Midwest State are Spending New Federal Funds, Molly Bolan, Route Fifty, Sep. 7, 2022, with examples on how policymakers across Ohio have used American Rescue Plan Act funds to invest in activities like workforce development and addressing inequality through infrastructure.

- Finding American Rescue Plan Funding in Your Community, Children’s Funding Project, a database that shows different American Rescue Plan Act funding sources governments can use to support children and youth.

Worth Watching

- ARPA and Philanthropy: Seizing the Once-in-a-Generation Opportunity (58:37), Council on Foundations, Sep. 14, 2022, discussing how philanthropy can encourage local governments to allocate ARPA funds for nonprofits, with an overview by the National Council of Nonprofits and testimonials from two foundations on how they secured funding and advanced equity in their communities.

Trend Spotting: Employment Policies

Paid Sick Leave: On July 1, New Mexico’s paid sick leave law went into effect, requiring private employers of all sizes, including nonprofits, to allow their workers to accrue and use one hour of paid sick time for every thirty hours worked. The law applies to full-time, part-time, and seasonal workers. The state joined the growing list of cities, counties, and states with paid sick leave requirements, with Colorado and Virginia also enacting similar laws during the pandemic.

Student Loan Relief: Last week, New York enacted a law that expands and simplifies access to the federal Public Service Loan Forgiveness (PSLF) program for public service workers in the state. Public service employers, including charitable nonprofits, will be permitted to certify employment and share necessary data with the U.S. Department of Education to streamline processing for workers. The new law requires public service employers to provide annual notice of renewal and a copy of the certification form for certain workers. The law further expands the definition of “full-time” to at least an average of 30 hours per week for the purposes of public service, which clarifies and allows more borrowers to access the program. A bill awaiting California Governor Newsom’s signature would establish the Golden State Social Opportunities Program to provide grants to certain social work, therapy, or psychology students who commit to working at an eligible nonprofit in California for their required post-degree hours.

Government Grants and Contracting Liaisons

As identified in our report, The Scope and Impact of Nonprofit Workforce Shortages, nonprofits often cannot raise employee wages or change compensation packages because of constraints in government grants and contracts or a lack of responsiveness by government officials. A bill in California awaiting action by the Governor would address this latter challenge by requiring each state agency that does significant business with or has policies that affect nonprofits to have a designated nonprofit liaison to address nonprofit complaints, provide technical assistance on agency policy compliance, develop innovative contracting policies, and report nonprofit concerns to agency leadership. CalNonprofits helped lead the advocacy efforts in support of the Nonprofit Liaison positions, stating in a nonprofit coalition letter that the liaisons “could offer in-house expertise on the nonprofit sector, to help ensure that contracts and grant programs account for the unique ways in which nonprofits do business and to support contract and grant compliance.” Separately, New York City is searching for an Executive Director for the new Mayor’s Office of Nonprofit Services, which will lead the development and implementation of a capacity building program for nonprofits seeking to partner with the City and improve equity and inclusion in the City’s contracting with nonprofits.

Worth Quoting

- "Government contracts often do not adequately fund overhead costs which must be covered too. Overhead is capacity. It is the building where business is conducted, it is the software used to track outcomes and expenditures, it is the truck and the gas used to deliver food, and, most importantly, it is the people that coordinate all the support functions that make the outcome possible.”

— Lisa Maruyama, Nanci Kreidman, En Young, Karen Tan, writing in Government Support For Nonprofits Only Goes So Far, Community Voice, Sep. 14, 2022, advocating for a new model for governments to partner with nonprofits to meet community needs.

Worth Reading

- A commitment to advancing racial equity, Martin M. Looney and Matthew Ritter, Hartford Courant, highlighting efforts to promote racial equity though evaluation of potential disparities of proposed legislation prior to adoption, a process that leads to racial and ethnic impact statements (REIS).

Numbers in the News

50%

The percentage of women who indicated they are “very enthusiastic” about voting in state elections, according to a survey commissioned by YWCA USA to “understand the concerns and priorities of women in the United States.” Survey findings looked at women’s concerns by categories that include mental health and child care, and disaggregated results by race and generation.

Source: YWomenVote 2022 – Midterm Election Study, YWCA, Aug. 26, 2022.

September is

Hispanic Heritage Month (Started September 15)

Suicide Prevention Awareness Month

Upcoming Events

- Sept. 20, Joint Policy Facilitation (virtual), Nonprofit Association of the Midlands

- Sept. 20-22, WV Nonprofit Leadership Summit, West Virginia Nonprofit Association

- Sept. 21-23, Annual Conference – Virtual, Montana Nonprofit Association

- Sept. 22, Legislative Candidate Education Roundtable, Alliance of Arizona Nonprofits and Arizona Grantmakers Forum

- Sept. 22, Lobbying & Electioneering for Nonprofits, Pennsylvania Association of Nonprofit Organizations

- Sept. 27, Nonprofit Leadership Summit, New Hampshire Center for Nonprofits

- Sep. 27, Federal and State Legislative Breakfast, NetworkPeninsula (Virginia)

- Sept. 27-29, UNA Annual Conference, Utah Nonprofits Association

- Sept. 28, 2022 Conference for Louisiana’s Nonprofits, Louisiana Alliance for Nonprofits

- Sept. 28-29, Annual Conference – In Person, Montana Nonprofit Association

- Oct. 3, 47th Annual Convention & Expo, Providers’ Council (Massachusetts)

- Oct. 4, Local Legislative Breakfast, NetworkPeninsula (Virginia)

- Oct. 6-7, Virtual HANOCON 2022, Hawaiʻi Alliance of Nonprofit Organizations

Tomorrow is National Voter Registration Day!

Thousands of nonprofits will participate in one of the largest celebrations of democracy in our nation’s history tomorrow, Tuesday, September 20th: #NationalVoterRegistrationDay (NVRD). Over NVRD’s ten years, more than 4.7 million people have been registered to vote through the nonpartisan outreach efforts of nonprofits and others. This year’s goal is to register another 800,000 people and be #VoteReady. Check out Nonprofit VOTE’s nonpartisan toolkits and tips on how to engage your communities to register and exercise the right to vote. Together, we can help our communities celebrate this milestone anniversary and make it the best year yet.

Share Your Experiences with Race in the Nonprofit Sector

With your help, the Race to Lead Survey from the Building Movement Project is building the largest dataset on race and leadership in nonprofits to inform and improve the sector. The survey captures personal experiences – good or bad – that contribute to a collective story and the potential to transform the nonprofit sector. Previous surveys conducted in 2016 and 2019 have dispelled myths about leadership readiness, informed DEI efforts across organizations, and helped shape public policies.

Unlike many surveys that are intended for one response per organization, the Race to Lead survey recognizes that every individual's experience is different - even within one organization - and so they are looking for as many individual responses as possible.

Please take and share this survey with everyone you know in the nonprofit sector to contribute to new understandings of how these changes are impacting all nonprofit workers, leaders and organizations.

Yes, It's Okay to Ask

Contrary to the assumptions of some, election season isn’t a time for charitable nonprofits to lay low and avoid engaging with candidates for public office lest they be considered acting in a partisan manner. True, nonprofit nonpartisanship is the law and the smart way to maintain public trust. But the number of days before an election doesn’t define when or whether nonprofits can ask politicians what they think. Indeed, when is better than while candidates are seeking votes? A tried, true, and tested technique for parsing what politicians truly believe is the Candidate Questionnaire.