The Price of Congressional Dysfunction

The dysfunction in Congress is so much more than a political science curiosity and gold mine for late-night comedians. It means that the people nonprofits serve will continue to be hurt and be denied critical services that improve lives and communities. Almost two weeks ago, the House fired Speaker McCarthy and has yet to elect a new Speaker, leaving that chamber unable to take action. In the meantime, war broke out in the Middle East and continues to ravage Ukraine, while here in the U.S. health and child care supports have ceased for millions of people. And the flood of immigrants has only gotten worse, imposing extreme stress on charitable organizations providing relief and on cities receiving tens of thousands of new residents. Regardless of who the House decides will serve as Speaker – a hard-right firebrand, an interim placeholder, or a candidate with whom House Democrats negotiate a power-sharing agreement – the historic disruptions to “regular order” will hinder effective policymaking for the rest of the year, and perhaps beyond.

Bipartisan Movement on Nonprofit Priorities Despite Dysfunction

At a time when partisanship is at its highest and expectations from Congress at their lowest, the ability to achieve bipartisanship on issues important to charitable nonprofits is emerging as a storyline worth highlighting. Here are three newly introduced bills that, if enacted, would provide real relief to charitable organizations, the people who support them, and the people they serve:

- Streamlining Federal Grants: Last week, Representatives Marie Glusenkamp Perez (D-WA) and Virginia Foxx (R-NC) introduced the House version of the Streamlining Federal Grants Act (S. 2286/H.R. 5934). The legislation seeks to improve the effectiveness and performance of federal grants and cooperative agreements, simplify the application and reporting requirements, and facilitate greater coordination among federal agencies responsible for delivering services to the public. Notably, the bill mandates consultation with charitable nonprofits and governments and calls for improving services delivered to communities and organizations that historically have not received federal grants or cooperative agreements. See the bill summary and the National Council of Nonprofits analysis.

“I’ve heard from local governments, first responders, and nonprofits across Southwest Washington that accessing federal grant funding is just too difficult,” said Rep. Gluesenkamp Perez. “The Streamlining Federal Grants Act would cut unnecessary red tape by standardizing the rules, forms, and notices for grant applications across federal agencies. It would make a real difference for small, rural, and underserved communities in our district.”

“The federal government relies heavily on charitable nonprofits to perform services in every community across the United States. Yet the federal grants process is needlessly complex, exclusionary, and a reason the current nonprofit workforce shortage crisis is so severe,” said National Council of Nonprofits President and CEO Tim Delaney. “The networks of the National Council of Nonprofits strongly support the Streamlining Federal Grants Act as a needed step in de-complexifying federal grant making and providing clarity and fairness that will benefit all Americans.” - Raising the Charitable Mileage Rate: Senators Amy Klobuchar (D-MN), Ted Budd (R-NC), and Tina Smith (D-MN) have introduced the Senate version of the Volunteer Driver Tax Appreciation Act (S. 3020/H.R. 3032). The bill would increase the charitable mileage rate for nonprofit volunteer drivers delivering people or products on behalf of nonprofits to the standard business rate, currently set at 65.5 cents per mile, and eliminate taxation of mileage reimbursements up to the business rate. The current charitable mileage rate, set in 1998, is only 14 cents per mile. The House bill was introduced in April by Representatives Pete Stauber (R-MN) and Angie Craig (D-MN). See the Klobuchar news release.

“Volunteer drivers provide critical services to predominantly rural areas of our country. Seniors, veterans, and disabled citizens are able to access food and healthcare through the charitable work of others. Increasing the charitable mileage reimbursement rate will make it easier for volunteer drivers to continue giving of themselves and helping more people. Thank you to Senator Klobuchar for leading this vital legislation,” said Senator Budd. - Voting Rights Restoration: Last month, Representative Sewell (D-AL) reintroduced the John R. Lewis Voting Rights Advancement Act of 2023 (H.R. 14) with 214 cosponsors, including 13 Republicans. The legislation would establish new criteria for determining which states and political subdivisions must obtain preclearance before changes to voting practices may take effect. States and political subdivisions that meet certain thresholds regarding minority groups would be required to secure preclearance of covered practices e.g., redistricting, before implementation. Finally, the bill outlines factors courts must consider when hearing challenges to voting practices, such as the extent of any history of official voting discrimination in the state or political subdivision.

In introducing the bill, Representative Sewell said, “Generations of Americans—many in my hometown of Selma, Alabama—marched, fought, and even died for the equal right of all Americans to vote.” She continued, “It would prevent restrictive, discriminatory voting laws from taking effect and ensure every eligible American can have their vote cast and counted.”

Federal FastView

- Protecting student loan borrowers from scammers: Student loan payments resumed this month, and many borrowers are making a payment for the first time. Recognizing the confusion and how scammers can take advantage of it, Representative Virginia Foxx (R-NC), Chair of the House Education and the Workforce Committee, sent a letter to Education Secretary Cardona raising concerns about the vulnerability of borrowers during this period. The letter also requested information on actions the Department of Education has taken to “protect against debt relief scams” and enforcement actions. The Department of Education published “Avoiding Student Aid Scams Page” on its website, providing more information on recognizing potential scams.

- Calculating Unemployment Insurance Fraud: Fraudulent claims for unemployment benefits of between $100 billion and $135 billion were improperly paid during the pandemic, according to a new report by the Government Accountability Office. Seeking to provide funds quickly to people out of work at the start of the pandemic, governments permitted individuals to self-certify eligibility, which overwhelmed older computer systems at understaffed state agencies. The U.S. Department Labor is working with states to upgrade systems and improve practices to avoid future fraud and abuse.

- Scrutinizing the Form 1023-EZ: The publication Law360 conducted a detailed analysis of the short form used by the IRS to ease its administrative burden but at the high cost of exposing the public and the charitable sector to profound risks, “Scrutiny Of Nonprofits Prompts Push To Ax Short Application” (premium). At issue is the IRS Form 1023-EZ, the application for tax-exempt status that has consistently been panned by the National Council of Nonprofits, state charities officials, and the IRS’s own Taxpayer Advocate for failing to screen out ineligible applicants. The article found that the Form 1023-EZ presents an opportunity for bad actors to masquerade as legitimate nonprofits to get monetary donations under false pretenses and dodge taxes. "Even just one fraudster let in is one too many because nonprofits rely on the public's trust," said Tim Delaney, President and CEO of the National Council of Nonprofits. "And one bad actor can do a lot of damage to individual donors and the reputations of thousands of legitimate nonprofits that comply with the law."

-

Measuring Arts Impact: Nonprofit arts and culture organizations and their audiences generated $151.7 billion in economic activity in 2022 — $73.3 billion in spending by the organizations, which leveraged an additional $78.4 billion in event-related spending by their audiences – according to a new report Arts & Economic Prosperity 6 from Americans for the Arts. In addition, the report found that arts-related economic activity supported 2.6 million jobs, generated $29.1 billion in tax revenue, and provided $101 billion in personal income to residents. The report provides detailed findings on 373 regions from across all 50 states and Puerto Rico—ranging in population from 4,000 to 4 million—and representing rural, suburban, and large urban communities.

Well Worth Your Time

Major Proposed Rules Affecting Nonprofit Operations (and Success)

In the coming months, federal officials will be making decisions on the rules governing nonprofit pay practices, improving access to federal and pass-through grants, and more. How well those officials tailor regulations to address the realities of nonprofit operations depends on input not just from organizations like the National Council of Nonprofits, but also from individual charitable nonprofits from different parts of the country telling their stories with data and other details. Here’s what’s at stake and what individual nonprofits can do about it:

- Overtime Proposed Rule: The U.S. Department of Labor is proposing to modify the rules governing which employees are exempt from overtime pay. In draft regulations, the Department is asking the public to share insights and opinions by submitting a comment on the advisability of increasing the minimum salary level that executive, administrative, and professional employees must be paid (from $35,568/year to $55,068/year or higher) to exempt them from overtime pay of time and half of wages for hours worked in excess of 40 in any week. The Labor Department is also proposing raising the minimum salary level for “highly compensated employees” from $107,432/year to nearly $144,000/year and establishing a mechanism for automatically raising these salary levels in the future. The Department is not proposing changes to the duties tests for white collar employees.

- Learn More: Evaluating the Labor Department’s Overtime Proposed Rule.

- Submit Comments: Public comments on the Overtime Proposed Rule are due by Nov. 7, 2023.

- Federal Grants Reforms: The Office of Management and Budget is proposing significant changes to the rules governing federal grantmaking that would correct longstanding challenges that have limited nonprofit effectiveness, discouraged qualified organizations from seeking federally funded grants, and wasted billions of dollars and countless hours in jumping through needlessly complex reporting requirements. The proposed changes include numerous nonprofit-friendly reforms including raising the de minimis indirect cost rate from 10% to 15%, prohibiting federal agencies from pressuring organizations to accept lower reimbursements for indirect costs, and creating what amounts to an appeals process when federal agencies fail to follow OMB guidance.

- Learn More: The Streamlining Federal Grants Act and the Benefits to Charitable Nonprofits and Pending federal grants reforms could make life easier for nonprofits, Nonprofit Essentials, Oct. 11, 2023.

- Submit Comments: Public comments on Federal Grants Reforms are due by Dec. 4, 2023.

Guide to Submitting Comments: Taking the Mystery Out of Filing Comments on Proposed Rules is a brief, yet helpful guide on submitting effective comments to government rulemaking, covering such topics as why you should engage, tips for things to consider and include, and additional resources.

Worth Quoting

“De minimis rate. Recipients and subrecipients that do not have a current Federal negotiated indirect cost rate (including provisional rate) may elect to charge a de minimis rate of up to 15 percent of modified total direct costs (MTDC). The recipient or subrecipient is authorized to determine the appropriate rate up to this limit. Federal agencies may not require recipients and subrecipients to use a de minimis rate lower than this standard unless required by Federal statute.”

~ Proposed new language in 2 CFR Sec. 200.414(f), Notice of Proposed Guidance for Grants and Agreements, Federal Register, Vol. 88, No. 192, p. 69466, (Regulations.Gov), published Oct. 5, 2023.

Worth Reading

On the overtime proposed rule

- New Overtime Rules May Affect Nonprofits, Linda J. Rosenthal, For Purpose Law Group, Oct. 2, 2023.

- More on the Proposed Overtime Regulations, Linda J. Rosenthal, For Purpose Law Group, Oct. 5, 2023.

On the OMB Uniform Guidance proposed reforms

- Feds Propose Improvements to Grants Rules, The NonProfit Times, Oct. 9, 2023.

Support for the Child Care Sector in the States

Federal pandemic relief for child care ended on September 30, leaving many child care providers and parents around the country concerned about the impact on costs and accessibility. A provider in West Virginia has already reported that its staff has “taken a $400-a-month pay cut” and is concerned that employees will soon quit. In Oregon, a provider anticipates a funding gap given that federal aid covered an estimated 25% of the state’s Employment Related Day Care Program, a program that helped families afford child care. The state's Department of Early Learning and Care does not have the budget to make up the gap and will stop approving families on November 3, leaving families on a waitlist.

Not all states are expecting child care access to decrease, however, due to actions the states took earlier. In Minnesota, the Legislature made $575 million available over the next four years to support pay and benefits for the early childhood workforce, and increased the number of subsidized child care slots by more than 50%. Child Care Providers United in California negotiated a new state contract that ensures a 20% rate increase for providers that receive state reimbursements, as well as a retirement fund for child care workers, a new benefit. Aside from funding, Nebraska is looking at other barriers for child care providers such as fingerprint-based background checks. On October 11, the state Legislature’s Health and Human Services Committee held a hearing on legislation for an interim study, where many child care employees testified that the existing process is “cumbersome” and that delays in processing can put them at risk of losing their license.

States Getting Serious About Grants Reforms

Since before the depths of the pandemic, charitable nonprofits have been advocating for reforms to outdated and complex government grantmaking and contracting practices and procedures that impose unnecessary costs, permit late and inadequate payments to nonprofits, and result in barriers that prevent organizations from applying for and performing under agreements to provide services. States are now adopting and/or carefully evaluating the impact of poor rules and regulations on nonprofits and the people they serve.

- Advance Payment: This month, California enacted legislation authorizing state agencies to provide advance payment of up to 25% of the total amount of a grant or contract to nonprofits that meet certain minimum requirements. It also calls for prioritizing recipients and projects serving disadvantaged, low-income, and under-resourced communities. Governor Newsom’s message upon signing the bill stated, “I am committed to expanding equitable access to state grants and contracts, and the utilization of advance payments is a strategy that may support various nonprofits working with disadvantaged, low-income, and under-resourced communities.” The law’s result is that nonprofits can begin work without having to front millions of dollars before reimbursement payments begin.

- Grants Modernization Task Force: The Governor of Oregon has appointed nine nonprofit members to the 15-member legislative Task Force on Grant Making and Contracting, a panel created to address a long list of challenges that nonprofits face in providing services on behalf of the state. Among other things, the two-year task force is charged with developing recommendations for improving wages for employees of nonprofit organizations, uniform application procedures and standard contracting language, multi-year contract terms, and payment models that prioritize full-cost recovery. To assist the work of the task force and ensure as many nonprofit voices and experiences are heard, the Nonprofit Association of Oregon, which led the advocacy efforts, has been convening nonprofit leaders around the state in “policy labs” to discuss specific grantmaking and contracting topics that will then develop into formal recommendations.

Evaluating the Use of State and Local Fiscal Recovery Funds

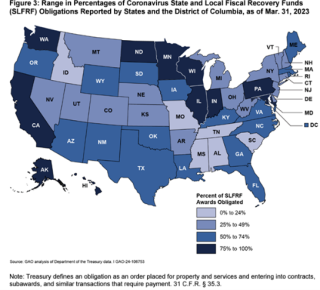

Governments have until December 31, 2024, to allocate their share of the $350 billion in Coronavirus State and Local Fiscal Recovery Funds authorized under the American Rescue Plan Act (ARPA), and new data provide insights into which states still have funds to invest in charitable nonprofits. A new Government Accountability Office report found that states have obligated 60% of their funds and only spent 45% as of March 31, 2023. Minnesota and North Dakota report they have obligated nearly 100% of their funds, while Tennessee and Mississippi have spent no more than 20% of their State and Local Fiscal Recovery Funds. A significant portion of the dollars has simply been put in the general fund of the governments, calling it “revenue replacement.” The next biggest category of spending has been on projects designed to address the negative economic impacts of COVID-19.

Local Opportunities for Nonprofits. The GAO report also found that local governments have only spent 38% of their awards. Many smaller governments have not spent their funds “due to their limited experience with receiving federal funds,” according to the Treasury Department, making it essential for nonprofits to reach out to local leaders and partner to use their funding.

Investments in charitable nonprofits continue to be announced, providing examples for nonprofits and governments to consider and propose in their own communities.

- The City of Lowell, Massachusetts, announced another round of ARPA funding that allocates nearly $1 million for local nonprofits and artists.

- On October 11, the Tulsa, Oklahoma, City Council approved more than $6.9 million in ARPA funds to distribute to nonprofits in the city.

- The High Point, North Carolina, City Council Finance committee is reviewing 58 applications to distribute ARPA funds in projects and, while the plan is to reimburse recipients, the committee is considering “advancing some of the funds to organizations,” which is encouraged given that many nonprofits cannot afford to wait for a reimbursement.

For more examples of projects and how to secure funding, see Principles, Recommendations, and Models for Investing Coronavirus State and Local Fiscal Recovery Funds.

Worth Reading

- Charitable giving incentives empower working families, strengthen nonprofits, Kelley Kuhn, Kyle Caldwell, and Phil Knight, Crain’s Detroit Business, Oct. 11, 2023.

States Enact Data Privacy Laws

Twelve states have enacted data privacy legislation, so far. Laws in Connecticut, Colorado, Virginia, and Utah go into effect this year; of those, only Colorado includes nonprofits under compliance requirements. Indiana, Iowa, Montana, and Texas become effective next year. The laws determine how consumers’ data may be used, collected, and shared. For-profit companies and others collecting data may be required to delete, correct, or protect certain data if asked for by the consumer. Last week, California Governor Newsom signed the Delete Act (S.B. 362) to update the first data privacy law in the nation, the California Consumer Privacy Act, enacted in 2018 and updated in 2020. The Delete Act creates a one-stop shop for individuals to delete personal data and imposes disclosure and registration requirements on any data broker “that knowingly collects and sells to third parties the personal information.”

Vote Early Day is Coming

Vote Early Day is on October 23! Join as a community partner and help make the process easier for eligible voters to understand how, where, and when to vote in their areas, all while staying nonpartisan. A force multiplier for voting, Vote Early Day helps nonprofits, businesses, and individuals to help voters be #VoteReady with social media graphics and voter tools for the upcoming elections. Nonprofits can join as a community partner and get involved today!

Numbers in the News

$151.7 billion

The economic activity generated by nonprofit arts and culture organizations and their audiences in 2022, according to a study released by Americans for the Arts. Findings showed that this economic activity supported 2.6 million jobs and generated $29.1 billion in tax revenue.

Source: Arts & Economic Prosperity 6, Americans for the Arts, Oct. 12, 2023.

Nonprofit Events

- Oct. 19, MNN Annual Conference, Massachusetts Nonprofit Network

- Oct. 20, Town Hall on Overtime Proposed Rule, North Carolina Center for Nonprofits

- Nov. 1, Annual Conference, Nonprofit New York

- Nov. 2, Nonprofit Summit of the Midlands, Nonprofit Association of the Midlands (Nebraska)

- Nov. 2-3, Conference for NC’s Nonprofits, North Carolina Center for Nonprofits

- Nov. 15, Annual Policy Convention, CalNonprofits

Nonprofit VOTE Webinar

Top 10 Tactics Nonprofits Can Employ to Get Out the Vote

Oct. 25 at 2:00 pm Eastern.

As elections near this year, partners from the field will share recommendations for nonprofits to get out the vote and ideas on how to host phone and text banking, provide nonpartisan information about what’s on the ballot, and explain how to help individuals of all abilities develop a voting plan. Register now.

Advocating via Education and Collaboration for Consistency, Not Change

Advocacy is the art of advancing policy priorities through the appropriate policymakers in the appropriate forum using the appropriate tools in the advocacy toolbox. Certainly, competition between opposing sides on an issue (for example, being for or against a specific piece of legislation) is one tool in certain situations. But advocacy does not necessarily mean adversarial. Other situations may call for use of different powerful tools, such as collaboration and community engagement. Or, for those who want to stick with the competition framework, draw the lines defining the opposing sides in a way that, instead of seeing government as the opposition, recognizes that government officials can be allies in advancing the public good.

Also, the good to be advanced doesn’t always have to be about seeking change. An oft-overlooked form of advocacy is simply keeping policymakers, officials, and the media updated about what’s happening in the regulated community so they can make informed tweaks or adjustments to improve policies and practices instead of making wholesale, disruptive changes.

Stay in the Loop

Want to be the first to know policy developments and operational trends affecting nonprofits? Sign-up to receive our free newsletters, Nonprofit Champion and Nonprofit Essentials, and browse the archive of past editions.

Sign-Up