What Congress “Must” Get Done by Year’s End

Having punted its heaviest lifting until January and February – funding the government and extending the Farm Bill (which includes SNAP benefits) – Congress still has significant “must-pass” bills in the waning days of this session. Partisans will argue over what is essential, but several items tend to be most commonly cited on the “must-pass list” for pre-holidays action. Most notable are the two supplemental spending bills requested by the Administration. Aid for Ukraine, Israel, and Taiwan has strong, bipartisan support in the Senate, but House Republicans remain split over passing any additional relief for Ukraine. A separate supplemental package for domestic disaster relief appears to be on hold until the foreign funding bill is resolved. Numerous agenda items of the charitable community, including restoration and expansion of the non-itemizer deduction (Charitable Act), remain sidetracked by negotiations over competing demands for an extension of the Child Tax Credit in exchange for repeal of three business taxes.

Worth Reading

- Schumer Dear Colleague On The Upcoming Work Period, Office of Senate Majority Leader, Nov. 26, 2023.

- Conservative heavyweights call on Congress to expand Child Tax Credit (premium), Politico Pro, Nov. 14, 2023.

The Promise of Government Grants Reforms

Charitable nonprofits are on the verge of securing their most significant policy gains since the depths of the pandemic, not via high-profile legislation and tax breaks but through regulatory reforms and below-the-radar bills devoted to improving government grants to organizations. Recognizing that about a third of nonprofit revenue comes from government grants (as opposed to less than 15% from donations of all types), reforms to government grants policies and practices can have outsized impact on the ability and sustainability of charitable organizations to serve their communities.

Pending policy proposals are very good and can be secured, and even improved, with concerted advocacy by nonprofits.

- Historic Regulatory Reforms: The Office of Management and Budget (OMB) is proposing to revise its rules governing federal grants to guarantee nonprofits and others a minimum indirect cost rate of 15 percent, empower organizations to protect their rights, clarify funding notices, and more. While historic, the reforms should go further to, among other things, encourage grantmaking agencies to provide advance payments instead of relying solely on reimbursable grants; expand technical assistance and capacity building grants; discourage the use of match requirements for essential services; and create a streamlined, less onerous process for nonprofits and governments to which Congress has designated funding via earmarks (called Congressionally Directed Spending in the Senate and Community Project Funding in the House).

ACTION NEEDED: Charitable organizations have the opportunity to submit public comments to OMB that explain the need for and impact of the proposed regulations. Because silence could be misconstrued as indifference, we encourage all nonprofits to file comments by the due date of Monday, December 4. To make it easier, we’ve developed a nonprofit-focused analysis of the proposals and prepared Template Comments that you are free to adapt and submit. Submitting public comments to federal rulemaking is as easy as typing your thoughts into the comments box; learn more: Taking the Mystery Out of Filing Comments on Proposed Rules.

- Bipartisan Federal Legislation: Today, a letter to congressional leaders signed by more than 800 charitable nonprofits is headed to Capitol Hill urging support for The Streamlining Federal Grants Act (S. 2286/H.R. 5934), a bill to address many of the challenges that nonprofits experience with federal grants. Among other things, the legislation would establish a Grants Council to provide guidance to federal agencies on streamlining and simplifying grant applications and reporting requirements; improve nonprofits’ user experiences with federal grants; and mandate that government agencies solicit input from nonprofits and other partners on ways to improve the delivery of services to communities through federal grants. The legislation complements the regulatory reforms also under consideration.

ACTION NEEDED: Learn more about how the legislation would positively affect charitable organizations. The nonprofit letter will be updated regularly with new signers, so please sign onto the letter to show even wider support.

Grants Reform Webinar Recap

On November 20, hundreds of charitable nonprofit leaders participated in a nationwide webinar, The Urgency of Government Grants Reform for Your Nonprofit. Presenters explained the consequences of bad grantmaking policies, such as nonprofit workforce shortages and organizations getting shut out of grants. They also laid out legislative and regulatory solutions that individuals can help influence to ensure reduced burdens, greater access to funding, and better outcomes. View the presentation slides and the recording of the program. And Take Action.

Federal FastView

- Terrorism Financing, Free Speech, and Tax Exemptions: Organizations providing financial support or resources to designated terrorist groups would lose their tax exemption under newly introduced bipartisan legislation (H.R. 6408). “Under no circumstances should organizations supporting terrorism be allowed to receive preferential treatment under the U.S. tax code,” stated Rep. Kustoff (R-TN) in a the press release introducing the legislation. Separately, the House Ways and Means Committee recently held a hearing, Investigating the Nexus Between Antisemitism, Tax-Exempt Universities, and Terror Financing, focusing on protests on college campuses and specific foundations with ties to the Middle East. While much of the attention during the hearing was on militant speech by student organizations, Committee Chair Smith (R-MO) sought to chastise university presidents, whom he accused of having “sought to placate the most radical voices on their campuses.”

- Proposed Regulations on Donor Advised Funds: The Treasury Department and Internal Revenue Service have released long-delayed proposed regulations seeking to provide guidance on donor advised funds (DAFs). These include proposed definitions for who or what qualifies as a DAF, donor, and donor-advisor, as well as exceptions to the definition of a donor advised fund. Included in the definition of DAFs would be some giving circles, field of interest funds, and other committee funds. The draft regulations also propose an "anti-abuse rule" meant to deter donors from using DAFs to avoid excise taxes on donations to individuals. This set of proposals does not answer numerous questions, such as paying to attend charity dinners with DAF assets, treatment of payment of an individual’s pledge to a charity, and use of DAF funds to create new public charities. The public is invited to submit public comments by January 16, 2024.

American Rescue Plan Act Funds for Nonprofits

Governments around the country continue to invest their shares of $350 billion in Coronavirus State and Local Fiscal Recovery Funds, most notably in the work of charitable nonprofits. Both to encourage and inspire nonprofits to advocate for a share of remaining funds, Nonprofit Champion will continue to share examples until the funds can no longer be allocated after 2024.

- The City of Royal Oak, Michigan, awarded $278,000 in grants to nine area nonprofits. In announcing the grants, City Manager Paul Brake said, “There are countless members of the community that have been direct beneficiaries of the work these organizations do, and have avoided crises in their lives as a result.” He added, “nonprofit organizations have always been a critical partner in the effort to serve Royal Oak residents.”

- Arts nonprofits in Baltimore, Maryland, have until December 18, 2023, to apply for the 2024 ARPA Community Grant Program, which will award between $10,000 to $500,000 to local nonprofits providing “high-quality art experiences and activities.”

- Albany County, New York, has opened applications for the second round of its $1.5 million in Nonprofit Recovery Grants. Applications must be submitted before January 5, 2024.

- Earlier this year, Oklahoma’s Legislature approved $10 million in funds for an Oklahoma Arts Sector ARPA Grants program. Nonprofits that already submitted their eligibility verification documents must apply before December 15 to be considered for a grant request.

More States Consider Tax Credits for Child Care

As the year winds down, two states are continuing to push tax breaks for child care programs. Lawmakers in Illinois are considering two measures that would ease tax burdens on licensed day care facilities. The first bill would exempt essential supplies for day care centers, such as food and beverages for children, diapers, wipes, first aid kits, smoke detectors, nap mats, and soap and hand sanitizer, from sales and use taxes. The second piece of legislation would exempt nonprofit licensed day care centers from property taxes beginning in 2024.

In Wisconsin, a bill introduced earlier this month would allow for-profit and nonprofit child care programs to claim a refundable tax credit up to $100,000 for expenses incurred for starting their program. The income and franchise tax credit would be equal to capital expenditures and administrative costs incurred or the amount of contributions made to a charitable organization. An employer may also claim a tax credit up to $3,000 per child for the amount paid directly to a child care program on behalf of an employee’s child, plus associated administrative costs. A separate measure moving through the Legislature would establish a child care reimbursement account program for qualifying child care expenses for children under the age of 13 and permit parents, legal guardians, others to contribute to the account and deduct up to $10,000 per account per year.

Lawmakers Acting to Protect Nonprofits, Houses of Worship

Legislators in Michigan have passed a bill to establish a crime of institutional desecration for destroying or vandalizing businesses, nonprofits, houses of worship, or other property, including digital and online assets. The measure would impose a punishment of up to 10 years of prison and a fine of $15,000 or three times the destruction or injury, whichever is greater, for violence based on the actual or perceived race, color, religion, sex, sexual orientation, gender identity or expression, physical or mental disability, age, ethnicity, or national origin of another individual or group. Nonprofits, including houses of worship, schools, libraries, museums, community centers, campgrounds, and their facilities and grounds are expressly included. “Unfortunately, we have seen as hate-based violence continues to rise, houses of worship, minority-owned businesses, cultural and ethnic community centers, and the like, have been the focus of increasing threats and vandalism, defacement, destruction, including right here in Michigan,” the bill’s sponsor Representative Arbit said upon passage. The bill is currently on the Governor’s desk. If signed, Michigan would join Colorado and Florida, which established Nonprofit Security Grant Programs, to provide further protections for nonprofits and houses of worship over the past two years. Arizona considered but did not pass a similar measure.

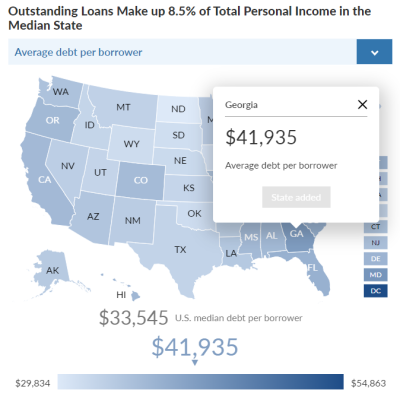

Student Debt and State Budgets

State budget revenues may be adversely affected by the restart of student loan payments after the three-year payment pause due to decreased purchasing power by individuals, according to an analysis by the Pew Charitable Trust. Diversion of the overall state personal income to student loan payments rather than goods and services will change tax collections and state economies. States that rely on sales tax revenues are particularly at risk. Pew compared the outstanding student loans as a share of total state personal income, such as wages, investments, property income, and employee or government benefits. This comparison shows states with the highest ratio, and thus the highest threat of lower tax revenues are Mississippi and Georgia, while Wyoming and Washington State have the lowest level of threat. Other economic factors like sales and use tax, corporate net income tax, and personal income tax collections are also expected to be affected by the restart in payments.

Worth Studying

On government grants policy and practices

- D.C. not abiding by its own Nonprofit Fair Compensation Act, Kimberly Perry and Gretchen Van der Veer, Washington Business Journal, Nov. 13, 2023.

Numbers in the News

25

The number of separate billion-dollar weather and climate disaster events during the first eight months of 2023, the highest number since records began in 1980. These events include 19 severe storms (tornado outbreaks, high wind, hailstorms) and two flood events. The total cost from these disasters exceeds $73.8 billion.

Source: Billion-Dollar Weather and Climate Disasters, Time Series, National Centers for Environmental Information, Nov. 8, 2023.

Nonprofit Events

- Nov. 28, Democracy Summit, AZ Impact for Good

- Dec. 1, Nonprofit Policy Caucus, NH Center for Nonprofits

- Dec. 6, Annual Nonprofit Conference, CT Community Nonprofit Alliance

- Dec. 6, NJ Nonprofits Conference, New Jersey Center for Nonprofits

- Dec. 13, Annual Policy Symposium, CalNonprofits

Let’s Get This Straight: Advocacy vs. Lobbying

Many a well-intentioned charitable advocate has been sidelined by colleagues, board members, and others who blurt out (incorrectly) “we can’t do that” when it comes to advancing public policy solutions. Most of us know the law on advocacy is virtually wide open and the few 501(c)(3) restrictions on lobbying, while real, are easily managed. Yet, longstanding confusion prevails, hindering the ability of charitable organizations to mobilize and have their greatest impact. The Florida Nonprofit Alliance has taken to social media to set things straight.

Stay in the Loop

Want to be the first to know policy developments and operational trends affecting nonprofits? Sign-up to receive our free newsletters, Nonprofit Champion and Nonprofit Essentials, and browse the archive of past editions.

Sign-Up