Happy Anniversary ARPA and SLFRF

Today, March 11, we celebrate the third anniversary of the American Rescue Plan Act (ARPA) with a call to action. The landmark law, and its important State and Local Fiscal Recovery Fund (SLFRF), have provided essential resources to nonprofits and communities to recover from the Covid pandemic. Yet time is running out; state and local governments must obligate what remaining SLFRF dollars they have by the end of this year or lose them. That means charitable nonprofits, which are expressly eligible to receive these funds, must act now to advocate for grant funding. An article in today’s The NonProfit Times, Seizing the Moment: Nonprofits Urged to Tap into Remaining American Rescue Plan Act Funds, lays out the resource development and advocacy steps for nonprofits to take with government officials to secure funds to advance missions. In addition, this new webpage, Accessing State and Local Fiscal Recovery Funds, provides background, nonprofit-specific answers to FAQs, and a template message for reaching out to government officials. Advocacy made sure that charitable nonprofits are eligible for SLFRF funds; now it’s time for development and advocacy professionals to work together to ensure the remaining funds are dedicated to solutions that nonprofits identify. Before it’s too late.

The Once and Future Government Shutdown Threat

This past week, Congress met a looming deadline for funding part of the federal government by passing a $459 billion package of six spending bills to fund federal departments and agencies that handle transportation, energy, housing, agriculture and veterans programs, among others. The bill contains $12.6 billion in earmarks that will pay for projects run by charitable nonprofits or local governments. It does not include controversial policy riders dealing with abortion, border politics, environmental issues, and voting rights. Congress must now turn to the next deadline for action – March 22 – which is when the temporary spending authority for the rest of the federal government expires. This package will include some of the most costly, and often most controversial, spending bills. Among them is the annual Labor, HHS, Education appropriation bill, which is the source for much of the federal funding for work performed by charitable organizations. The remaining bills likely will be the last major spending vote before the November elections. If Congress fails to pass the massive package by March 22, a large segment of the federal government could shut down, imposing outsized burdens on charitable nonprofits.

President’s FY ’25 Budget Proposals

Even as Congress struggles to complete action on the spending bills for the current year, the Biden Administration today released the President’s budget proposals for fiscal year 2025 that starts on October 1, 2024. The new set of requests to Congress largely reflect the Administration’s current policy priorities. The budget proposal claims it would cut the deficit by $3 trillion over the next decade “by making the wealthy and large corporations pay their fair share and closing tax loopholes.” It includes several proposals on access to homeownership and affordable rent, lowering health care costs, and student loan relief, plus renewing two proposals from prior years affecting private foundation spending. It is important to note that the President’s budget is merely a set of spending, tax, and other priorities that the Administration seeks from Congress. While often labeled “dead on arrival” by political opponents in any year, the budget request still serves as the start of the budgeting process and as a baseline for measuring whether Congress goes higher or lower that what the President is seeking.

|

Proposing Earmarks The new budget cycle means charitable nonprofits have the opportunity to ask their Representatives and Senators to include funding requests in appropriations for fiscal year 2025 for specific projects in their states and districts. Formerly known as “earmarks,” the requests are now called “community project funding” in the House and “congressionally directed spending” in the Senate. NOTE: The deadlines for submitting funding requests have already passed in some congressional offices and will close as early as this week in many others. Check the websites of your Representatives and Senators to learn more about their deadlines and their process for requesting support. |

Worth Reading

- FACT SHEET: The President’s Budget for Fiscal Year 2025, The White House, Mar. 11, 2024.

- Creating Funding Opportunities Through Advocacy, Advocacy in Action, Nonprofit Champion, Feb. 26, 2024, providing insights on how charitable nonprofits can make the case for earmarks and for funding under State and Local Fiscal Recovery Funds.

Time for Action

Promoting the Non-Itemizer Deduction

The House-passed tax bill (H.R. 7024) remains in limbo in the Senate over substantive and political disagreements. Some Republican Senators would like to revise some components of the legislation to expand the Child Tax Credit and restore three business tax breaks, or add new provisions, while others would prefer to scuttle action until after the elections to have greater input in the content. The legislation does not yet include restoration of the non-itemizer (universal) charitable deduction, an expired incentive that had provided taxpayers claiming the standard deduction the opportunity to get a tax break for donating to the work of charitable organizations. See the recent letter to Congress from the Charitable Giving Coalition: Restoring a Charitable Deduction for Non-Itemizers. It remains unclear whether the Senate Finance Committee will hold a markup on the bill and/or whether it could go directly to the Senate floor.

ACTION ITEM: Senators need to hear immediately from the charitable nonprofit community. Call your two Senators today and tell them: “The Senator must insist on restoration of the non-itemizer (universal) charitable deduction as a provision in any tax package under consideration.” You can also write your Senators to deliver the message via email and include a link to the new nonprofit community letter.

Worth Quoting

- “We urge you to heed their and our requests to take an important step to shore up America’s culture of giving—that is, by using the bipartisan Tax Relief for American Families and Workers Act or another must-pass legislative vehicle to restore a charitable deduction for non-itemizers effective this year.”

— Restoring a Charitable Deduction for Non-Itemizers, Charitable Giving Coalition, Feb. 27, 2024, attaching the coalition’s November letter in support of the deduction signed by more than 1,000 organizations from all 50 states.

Federal FastView

- Overtime Rule Update: The Labor Department reportedly has taken one of the last steps in finalizing its proposed rule on the salary threshold for overtime pay under the Fair Labor Standards Act by sending the text to the federal Office of Management and Budget (OMB) for review. As initially proposed last summer, the draft regulations would increase the minimum salary level that executive, administrative, and professional employees must be paid (from $35,568/year to $55,068/year) to exempt them from overtime pay of time and half of wages for hours worked in excess of 40 in any week. The proposal also called for raising the minimum salary level for “highly compensated employees” from $107,432/year to nearly $144,000/year, and establishing a mechanism for automatically raising these salary levels in the future. The timing of OMB's review now suggests that the final rule could be published as soon as this spring and could take effect this summer, although its implementation may (or may not) be delayed by expected court challenges. See Comments submitted by the National Council of Nonprofits.

- Effective Today – New Independent Contractor Rules: Starting today (Mar. 11, 2024), employers must comply with a new final rule from the Labor Department for determining whether workers are employees entitled to wage and hour compensation, or independent contractors. The new rule actually just restores the law to what was required before the Trump Administration reduced the number of factors that must be considered. See Department of Labor FAQs. At least four lawsuits have been filed challenging the new rule.

- Direct Pay Rules Finalized for Energy Tax Credits: The Department of the Treasury has finalized regulations governing direct payments of several clean energy tax credits provided by the Inflation Reduction Act. The rule allows charitable nonprofits and other tax-exempt organizations to receive direct payment of credits incentivizing energy projects, such as solar, wind and clean hydrogen. The new rule goes into effect May 10, 2024.

- Updates to the Child Care & Development Block Grant Program: On March 1, the Department of Health and Human Services released its final rule on changes to the Child Care and Development Block Grant. The changes aim to lower child care costs, expand options for families, and “reduce program bureaucracy for families.” One way is by establishing a policy requiring that co-payments cannot be more than 7% of a family’s income. It will also be easier for “Lead Agencies” to waive co-payments for “families with children with disabilities, families experiencing homelessness, and children enrolled in Head Start or Early Head Start,” among others.

The Corporate Transparency Act and Nonprofits

A new disclosure requirement under the Corporate Transparency Act (CTA) is causing confusion for charitable nonprofits because of both ambiguous language in the law’s exemption and pending litigation. The CTA’s “beneficial ownership report rules” are designed to create a robust corporate database at the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) that Treasury can use to target tax evasion, terrorists, money laundering, and other criminal activities often carried out through shell companies. Existing nonprofits with tax-exempt status are generally exempt from the CTA reporting requirements unless they lose their exemption or decide to form a subsidiary and/or enter into a joint venture with a for-profit entity where the nonprofit does not have total ownership and control. There is disagreement among nonprofit tax-law practitioners over whether the exemption applies to nonprofits whose applications for tax-exempt statuses are currently pending and nonprofits that are in the early formation stages. Adding to the uncertainty, a federal judge in Alabama recently ruled that the Corporate Transparency Act (CTA) is unconstitutional on the grounds that the law's mandatory disclosure requirements exceeded Congress’ authority. The decision will likely be appealed.

Voters: Gear Up for Democracy

Learning What You Need to Know to Vote

It seems like there’s an election somewhere in U.S. every week this year – including presidential primaries, special elections for vacant seats, additional primaries, and local elections. Each individual voter must know what the laws are in your state and become an educated voter for Election Day so you can fully participate. That’s easier said than done, given that many states have changed their rules. Voter registration deadlines, voting locations, and voting requirements vary by state and sometimes elections. So do poll worker rules and which officials oversee the elections. Fortunately, this helpful voting and elections webpage from US.gov provides links to get to your state and local election pages, register to vote, update voter registration, confirm voter registration status, see voter registration deadlines, learn about election laws and how candidates are elected, and more. Check it out today.

As a public service, we will be including nonpartisan “election tips” to help you prepare from now until Election Day in upcoming editions of Nonprofit Champion. No election tip constitutes legal advice, and everyone is encouraged to know your state’s election laws.

Worth Reading

- Nonprofit Power: Building an Inclusive Democracy, Nonprofit VOTE, March 2024, revealing how America’s trusted local nonprofits are doing effective voter engagement in historically underrepresented communities across the country.

Worth Watching

Nonprofits and Elections 2024: Why and How You Should Engage (and stay nonpartisan) (1:15:26), National Council of Nonprofits, Feb. 22, 2024. This nationwide webinar featured national experts explaining how charitable nonprofits can engage in the 2024 elections in legal and nonpartisan ways and – more importantly – why it’s to their missions’ advantage to get involved.

Addressing an Insurance Crisis

As insurance costs skyrocket, nonprofits across the country are reporting problems with finding and maintaining insurance coverage as insurance agencies have begun to refuse to write policies, cancel coverage, or increase premiums for nonprofits. State lawmakers are beginning to act to remedy these problems.

- Connecticut: A measure calls for a feasibility study of the impact of allowing nonprofits to pool insurance policies and establishing a captive insurance company to insure the risk of the pool. The study would look at both liability and automobile insurance as nonprofit service providers have been dropped by both types of insurance plans or have faced exorbitant increases in costs.

- Kentucky: Lawmakers are moving legislation to authorize disability income insurance and paid family leave insurance in the Commonwealth. Under the measure, paid family leave insurance could be included in a group disability income insurance policy purchased by an employer, offered as a supplemental policy provision to a group, or offered as a stand-alone group policy. It would cover any leave taken to provide care for a family member or bond with a child, among other permitted uses.

- South Carolina: A series of alcohol-related insurance and liability laws reportedly caused many insurance carriers to leave the state and significantly drove up premium costs by those that remained. To alleviate the burdens, legislation would lower the minimum required liquor liability insurance coverage for nonprofits and single day permit holders, and create the Fair Access to Insurance Requirements fund to assist with increased premiums.

Child Care Legislation in the States

Recent surveys on nonprofit workforce shortages found that challenges accessing child care impact the ability of nonprofits to recruit and retain employees. States around the country are also recognizing this crisis and advancing policies to increase child care availability and affordability.

- Idaho: Awaiting the Governor’s signature is a measure to establish the Office of Early Childhood Services to oversee child care, early education, and early childhood services, plus support early childhood services providers, assist families, and comply with federal laws and regulations.

- Kentucky: Legislation would task state government departments with establishing a Certified Child Care Community Designation Program to increase child care and early childhood education services. Another bill would establish an associate degree program for early childhood education entrepreneurship and create the Innovations in Early Childhood Education Delivery Fund for matching grants up to $100,000 to eligible applicants, including nonprofits, to increase early childhood education services.

- Maryland: A measure in the House would require prospective employees and volunteers at child care centers to undergo criminal background checks and would create a separate unit to process and manage the checks specifically for child care workers to hopefully streamline and lessen the burden for child care workers.

Worth Studying

- Constructing a Child Tax Credit That Fits Every State, Richard C. Auxier, David Weiner, Nikhita Airi, Tax Policy Center, Feb. 28, 2024.

Trend Spotting: Nonprofit Regulations

Several states are considering a range of regulatory measures that could impact charitable organizations.

- Alabama: Pending legislation would establish the Gaming Control Act to govern and oversee gaming in the state, and permit raffles and bingo for charitable fundraising.

- Mississippi: A regulatory reform bill would require nonprofits to file an annual report with the Secretary of State, among other things.

- South Dakota: A newly enacted measure makes a fraudulent solicitation of charitable contributions a deceptive act or practice, punishable under the criminal code.

- Tennessee: A nonprofit regulation bill (H.B. 1707/S.B. 1661) on the Governor’s desk would, among other things, increase the threshold to $50,000 for a charitable organization to be required to register and report the contributions to the secretary of state and require charitable organizations using a professional solicitor to file registration statements. Notably, the bill would also eliminate the requirement to include the amount spent on overhead in quarterly financial reports.

Worth Quoting

- “While the long arc of history in the United States may bend toward justice, the struggle for Black liberation has followed repetitive cycles of progress and backlash. From the abolitionist movement to reconstruction to the classic Civil Rights era to today, movements for racial justice have organized across racial lines to galvanize awareness and solidarity, and eventually win change. But these wins have also been followed by racist backlashes that reassert the old racial and economic hierarchies.”

— Reckoning with Sustainability: Black Leaders Reflect on 2020, the Funding Cliff, and Organizing Infrastructure, Building Movement Project, Feb. 20, 2024.

Numbers in the News

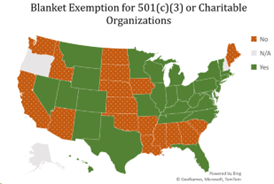

33

The number of states that provide a blanket sales tax exemption for charitable nonprofit organizations.

Source: Study of the Impact of Exempting Certain Nonprofit Organizations from the Sales and Use Tax and the Service Provider Tax, Maine Revenue Services Office of Tax Policy, Jan. 15, 2024.

50%

The percentage of New Jersey nonprofits that reported that they are experiencing “staffing shortages, with an average vacancy rate of 20%.” The main barriers identified include “difficulty offering competitive compensation due to budget constraints or insufficient funding; competition for employment,” and “worker shortages in specific professions or industries.”

Source: New Jersey Nonprofits Trends and Outlook 2024, New Jersey Center for Nonprofits, Mar. 6, 2024, demonstrating that the nonprofit workforce shortage crisis continues to rage.

March is

Nonprofit Events

- Mar. 14, Connect and Talk Story with Hawaii’s Congressional Delegation Staff, Hawaiʻi Alliance of Nonprofit Organizations

- Mar. 14, Nonprofit Policy Conversation – Asheville, North Carolina Center for Nonprofits

- Mar. 20, Advocacy in Action The Foraker Group

- Mar. 22, Nonprofit Policy Conversation – High Point, North Carolina Center for Nonprofits

- Mar. 28, Nonprofit Government Contracting Coalition, Nonprofit Association of Washington

“Teaming Up” to Build Bridges and Fight Polarization

“United across divides” is the message that welcomes visitors to the homepage of the Team Up Project, a campaign of four national nonprofits to bridge the polarized canyon our country currently faces. Catholic Charities USA, Habitat for Humanity International, Interfaith America, and YMCA of the USA launched this collective effort in 32 communities across the country to “showcase bridgebuilding in action, share stories about the positive impact of human connection and elevate ongoing organizational work.”

Stay in the Loop

Want to be the first to know policy developments and operational trends affecting nonprofits? Sign-up to receive our free newsletters, Nonprofit Champion and Nonprofit Essentials, and browse the archive of past editions.

Sign-Up