The Appropriations Grind is On

The debt limit and spending cut plan negotiated by President Biden and Speaker McCarthy last month was supposed to restore financial stability by establishing a bipartisan framework for upcoming spending decisions. Partisanship, however, seems to have other plans. House Republicans have advanced spending measures that, so far, are $119 billion below the budget levels agreed to by the Speaker and President that Congress then ratified in the Fiscal Responsibility Act of 2023 (P.L. 118-5). This appears to guarantee the appropriations process will be as tortuous, or more so, than usual when Congress doesn’t meet its deadline of enacting all 12 spending bills before the start of the new fiscal year on October 1.

The Fiscal Responsibility Act, includes an added incentive for Congress to reach agreement – an automatic cut of one-percent, across-the-board, in defense and non-defense spending if lawmakers fail to pass all 12 appropriations bills by the end of December. Intended as an inducement to reach agreement, some of the most conservative Members in the House appear to be flipping it by using delays and obstruction as tactics that could result in deeper cuts than Congress has already approved. Those tactics could trigger other consequences for nonprofits that have secured “earmarks” from Representatives and Senators. Called “congressionally directed spending” in the Senate and “community project funding” in the House, these line-item appropriations to individual charitable nonprofits and governments can be enacted only as part of appropriations bills; passage of a long-term Continuing Resolution would mean both an across-the-board spending cut and the absence of earmarks that may help organizations advance their missions.

Supreme Court Issues Landmark, Controversial Decisions on Affirmative Action, LGBTQ Rights, Student Loan Debt

The U.S. Supreme Court issued a series of controversial 6-3 decisions on the last days of its term that overturned long standing precedents as the conservative Justices banded together to redefine aspects of civil rights in America. The Court struck down race-conscious admissions at Harvard and the University of North Carolina (Students for Fair Admissions, Inc. v. Harvard College). In rejecting use of race as an admissions factor, Chief Justice Roberts wrote, “At the same time, as all parties agree, nothing in this opinion should be construed as prohibiting universities from considering an applicant’s discussion of how race affected his or her life, be it through discrimination, inspiration, or otherwise.” In 303 Creative LLC v. Elenis, the Court’s conservative block struck down a Colorado law that prohibited businesses that serve the public from discriminating based on sexual orientation, taking the position that the law violates a business's First Amendment rights. Finally, in Biden v. Nebraska, the Court ruled that the Biden Administration exceeded its authority in advancing a program to cancel student loan debt of up to $20,000 for more than 40 million borrowers. These three decisions affect the work of charitable nonprofits in varying ways and the underlying policy and constitutional questions will likely be before the courts for years to come. See the In Focus article below for the impact of the loan cancellation decision on the Public Service Loan Forgiveness Program.

Federal FastView

- Looming Child Care Cliff: On Sept. 30, federal pandemic-related funding for child care providers ends. As a result, 70,000 programs could close, eliminating 3.2 million slots and $9 billion in annual earnings by parents, according to a new analysis from the Century Foundation. Some states have taken action to shore up child care by providing wage supports, tuition relief, and other solutions. Also, several bills in Congress offer a variety of possible approaches to address the challenge, but cost and partisanship may prevent approval of more federal assistance. The child care cliff is of concern to charitable organizations, both as providers of child care and as employers struggling to attract and retain staff amid significant worker shortages.

- Opportunity Zone Tax Policy Falling Short of Expectations: A tax policy designed to boost economically challenged areas fails to deliver investments in the poorest neighborhoods and regions, according to a new report from the Treasury Department. The 2017 tax law created the “opportunity zone” tax incentive as a means of spurring private investments and economic activity in low-income communities. Treasury found that in the period 2018 to 2020 initial investments went to zones that already appeared to be on the rise, concluding, “Tracts that experienced growth in median household income, population, and housing values and reduction in the poverty rate and unemployment rate were more likely to receive qualified investment.” Treasury also found that Opportunity Zones in urban areas received 96 percent of investments, indicating that the policy was doing little to address rural economic challenges.

In Focus

Public Service Loan Forgiveness (PSLF) Program

While considerable attention has focused on the Supreme Court’s decision in Biden v. Nebraska to strike down the Biden Administration’s plan to cancel student debt, a powerful incentive supporting employment at charitable nonprofits and governments remains in full effect – and has even gotten better in recent days – while still more improvements are under consideration. The Public Service Loan Forgiveness (PSLF) program, enacted in 2008, enables individuals who work for 10 years at charitable nonprofits or governments to earn forgiveness of any remaining federal student loan debt. While the discussion of the President’s debt cancellation program touched similar themes, PSLF remains a valuable resource for nonprofit employers and employees.

- The Supreme Court and PSLF: Millions of student loan borrowers are disappointed that the U.S. Supreme Court struck down the Biden Administration’s debt cancellation program. However, the Court did not alter the ongoing benefits and protections that the separate PSLF program provides to employees of charitable nonprofits and governments. It is important to note that the majority opinion cites the Public Service Loan Forgiveness program statute as a positive example of when the Secretary of Education has proper authority to forgive federal student loan debt. The opinion uses the terms “cancellation” and “forgiveness” somewhat interchangeably, but the decision does not limit or otherwise restrict prospects for loan forgiveness available to workers at charitable nonprofits or governments under the PSLF program. Learn more.

- New Education Regulations Improving PSLF: More student loan borrowers, including workers at charitable nonprofits and governments, will be able to apply for loan forgiveness under the PSLF as the result of final regulations that went into effect on July 1. The rules will now count additional previous payments towards loan forgiveness (including certain periods of deferment, forbearance, and time in different repayment plans), ease administration for determining eligibility by permitting digital signatures from both employers and borrowers, allow for more types of loans (i.e. Direct and FFEL loans) to be consolidated or counted, and amend the definition of “full time” to mean 30 hours per week. See the PSLF Coalition’s FAQs for more information.

- Lowering Obstacles to Achievement Now (LOAN) Act: The number of payments and time required to qualify for debt forgiveness under the PSLF program would decrease and costs to attend college would be reduced under legislation pending in the House. The Lowering Obstacles to Achievement Now (LOAN) Act (H.R. 1731), introduced by Rep. Bobby Scott (D-VA), would shorten the time it takes to earn forgiveness from 120 payments to 96 qualified, on-time payments. It would also allow certain periods of forbearance and deferment to count towards forgiveness, expanding the ability for more nonprofit and public service workers to apply and receive forgiveness faster. The bill would also double the amount of individual federal Pell Grants, expand access to subsidized loans, eliminate capitalization, and lower interest rates for all new federal student loans.

Worth Reading

- Public Service Loan Forgiveness Untouched by Supreme Court Student Debt Rulings, Tiffany Gourley Carter, National Council of Nonprofits, June 30, 2023.

Worth Watching

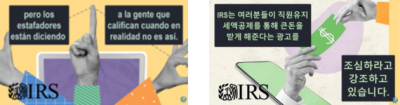

- IRS Warning: Don’t Fall for Employee Retention Credit Scams, English | Spanish | ASL | Chinese | Korean | Vietnamese | Haitian Creole | Russian

New Laws Affecting Nonprofits

July 1 marked the beginning of the new fiscal year in 46 states and the start date on several new laws of interest to charitable nonprofits.

- Audit Threshold: Effective July 1, the threshold for mandated audits of charitable nonprofits went up in Connecticut and Mississippi. The Connecticut law raises the state’s audit threshold from $500,000 to $1 million of gross revenue while requiring a less detailed review if the organization had gross revenue in excess of $500,000 but not more than $1 million. Mississippi raises the state’s audit threshold from $500,000 to $750,000 using a cash basis measurement. Recent changes to the audit threshold in Illinois and New Mexico go into effect at the beginning of 2024.

- Data Privacy: Many states have enacted data privacy laws over the past two years that provide protections for individuals and impose mandates on how various entities store and utilize personal data. The Colorado Privacy Act, which gives individuals more control over the information they share with entities, is the first such statute to extend new provisions to charitable nonprofits. Connecticut’s new Personal Data Privacy and Online Monitoring Act, that also went into effect on July 1, includes a nonprofit exemption.

- Employment Policies: A paid leave program of up to 12 weeks of family leave and 12 weeks of medical leave went into effect in Minnesota on July 1. Vermont’s VT Saves Program provides access to an individual retirement account for employees of employers, including nonprofits, that do not offer a retirement savings plan. Employees in Georgia can now take time off to vote, either on the day of an election or on one of the early voting days. Employers in New York City that use artificial intelligence tools in their hiring process must disclose this practice to candidates. Enforcement of the law began as of July 5; employers that violate the new law are subject to penalties that include an independent bias audit.

- Minimum Wages: Nevada increased its minimum wage to $11.25 per hour as of July 1 as part of a law enacted in 2019 that phases in increases each year through July 2024 when the minimum wage rate will be set at $12.00 per hour. The minimum wage also increased in Oregon, from $13.50 per hour to $14.20 per hour, although employees in the Portland metro area must be paid at least $15.45 per hour given that state law mandates a rate that is $1.25 more than the state minimum wage. Virginia amended its minimum wage for employees with disabilities, and only employers with a certificate issued by the U.S. Department of Labor may pay a subminimum wage.

- Taxes: Indiana now requires nonprofits that conduct sales on more than 120 calendar days per year to collect and remit sales tax. The state also increased its gas tax to 34 cents per gallon as part of its adjustments to inflation, which can make it more costly for volunteer drivers who perform services on behalf of charitable nonprofits. Eight other states also implemented increases in their gas taxes.

State Budgets and Nonprofits

Nonprofits secured some progress as state legislatures finalized their budgets before the start of the new fiscal year last week. Idaho’s budget includes $28 million for the Department of Labor to provide child care business grants. Enacted as part of its budget, Maine will require paid leave for workers and is providing $60 million in child care investments that include a wage stipend for child care workers.

The spending plan in Nebraska appropriates $40 million for grants up to $5 million each for nonprofit capital projects for qualifying nonprofits in arts, culture, humanities, or sports complexes. The budget approved in Utah establishes the Nonprofit Capacity Fund to fund the Nonprofit Capacity Grant Program to provide grants to certain nonprofit support organizations; the law permits taxpayers to contribute to the fund through check-offs on their income tax return.

The Minnesota Legislature allocated more than $5 million towards a grants administration unit tasked with creating a new grants management system. In the announcement, Marie Ellis, Public Policy Director at the Minnesota Council of Nonprofits, said, “We supported this increased financial oversight that the state proposed, because it’s a way for us to show the great work that [nonprofits are] doing.”

Worth Quoting

On nonprofit workforce shortages

- "As nonprofits struggle to meet an increasing demand for services — without an increase in funding — Vermont communities will continue to feel the direct impact of lower service capacities and a shrinking workforce."

~ Jesse Bridges, CEO of the United Way of Northwest Vermont, quoted in Centerpoint, Which Educates and Counsels Hundreds of Teens, Is Poised to Close, Alison Novak, Seven Days, July 5, 2023, discussing the closure of Centerpoint Adolescent Treatment Services, a nonprofit that provided counseling and educational services.

Worth Watching

On nonprofit workforce shortages

- ‘When nonprofits lose … communities suffer’: Nebraska charities face workforce shortages (2:45), Matt Chibe and Veronica Barreto, KLKNTV, June 28, 2023.

Numbers in the News

38.9

The median age in the United States in 2022, up from 35 years old in 2000 and 30 in 1980. Maine had the highest median age of 44.8 and Utah was the youngest at 31.9 years old. Median age is the age at which half of the population is older and half of the population is younger.

Source: America is Getting Older, Census Bureau, June 22, 2023.

July is

- Disability Pride Month

- National Black, Indigenous, People of Color (BIPOC) Mental Health Month

- National Park and Recreation Month

Nonprofit Advocacy Events

- July 25, Policy Call, Florida Nonprofit Alliance

- Aug. 3, Nonprofit Talent Summit, Momentum Nonprofit Partners (Memphis)

- Aug. 24, Nonprofit+Grantmaker Conference, Alliance of Arizona Nonprofits & Arizona Grantmakers Forum

- Aug. 29-30, Idaho Nonprofit Conference, Idaho Nonprofit Center

Nonprofit VOTE Webinar

Staying Nonpartisan for 501(c)(3)s

Tuesday, July 11 | 2:00 pm ET

Staying nonpartisan is critical to any and all voter-engagement activities in which charitable nonprofits engage, whether you're launching a large-scale voter education campaign, registering voters, convening town hall meetings, and beyond. This free webinar is dedicated to helping nonprofits understand what's allowed. Register now.

Preserving, Improving, and Promoting the Public Service Loan Forgiveness Program – For the Public Good

Effective advocacy comes in many forms, addresses diverse audiences, and requires the use of different skill sets over time. The federal Public Service Loan Forgiveness (PSLF) program serves as an ideal example of how nonprofit advocates have advanced the underlying public policy, preserved the support of policymakers and the public, and worked to ensure the promise of earned loan forgiveness becomes a reality for millions of workers.

Stay in the Loop

Want to be the first to know about trends and policy developments affecting nonprofits? Sign-up to receive our free newsletters and browse the archive of past editions.

Sign-Up